Motivations:

- Many of us have written our own "ad-hoc" tax programs or spread-sheets, which

need to be re-written each year as the tax code changes, etc..

Spreadsheets don't really do, as the number of entries for a

given category often changes, and they cannot handle all the

conditional calculations required in taxes.

It would be preferable if there were a common library of

routines which would be stable, but which could be used to

quickly describe new tax rules.

- By sharing an open-source tax-program, we might all benefit

by gaining a more complete and correct package.

- There are several commercial tax software packages, but they

are not available for every platform. An open-source package

can be used on all platforms, including Linux, Mac, and Unix in general.

- There are web-based tax filing options, but there are several issues with them.

Some of us do our taxes iteratively as we receive or find statements, not

in one shot. And what personal data is being sent across the net? Who is getting it? Storing it?

How well are they protecting it? Much more information is at stake here than with a simple credit card transaction.

(Social Sec. #, birth date, name, address, income, all of our bank accounts, etc..)

There were hundreds of thousands of identity theft cases last year.

Identity theft is becoming the fastest-growing financial crime in America and

perhaps the fastest-growing crime of any kind in our society.

Experts recommend minimizing the propagation of your personal information. E-file at your own risk.

- As a tax-payer, we expect to understand how our tax is

determined. Neither the government's forms, nor the commercial

tax preparation packages reveal, in a clear way, the tax

equations and the rules used. (As a programmer, I wish to

see the unambiguous expressions or code.

Consider this Fed-1040-For-Programmers.)

- Revealing the tax-law in concise -easily executable- form

enables us to better understand tax consequences of our decisions

throughout the year; not just at tax-time.

- The commercial software packages have become invasive.

They ask questions which do not seem to affect our tax.

On electronic submission, or even paper forms, we have little

visibility as to what information was used or passed.

- Commercial software packages have become bloated -

often requiring the installation of other packages we

may not otherwise wish to do. These

installations may be disruptive of our other software, perhaps

breaking other things on our systems, merely for the purpose

of, for example, adding video tax-wizards, etc..

- The commercial tax packages are awkward. Let's call the

"tax-interview" method "20,000" questions. Partially this is

a tribute to the complexity of our tax code itself, and all the

special cases therein. (For example, I live in a city and I'm

tired of TurboTax asking about my farming practices.)

If you accidentally err in making an entry, they sometimes drop into

a mode which will ask questions from unneeded forms on all future sessions.

Instead, a simple one or two page form, that can be easily

traversed and edited with your favorite text-editor, offers

many advantages, including the ability to view and print a concise

snapshot of your numbers, quick revisions, what-ifs, etc..

- Keep the tax-package simple and modular by being a basic text-oriented

program at its core; no graphical interface complexity. Require only

rudimentary knowledge to understand/modify the code.

(This should not preclude anyone from adding a GUI shell to

access it, or incorporating a GUI later. (Which has now been done.))

- Some additional comments submitted by various users:

- Not everyone can - or wants - to hire a tax pro. Some folks actually

like doing their own taxes. Some folks don't trust anyone else to do

it. It is unappealing to pay someone to do something you can do for free.

- I am already dismayed at paying so much taxes.

Why would I want to spend even more buying software to file them ?

If I can save those fees, I can instead take my family (or date)

out to a nice dinner.

- One of the worst things in doing taxes by hand, is when you get to the

end, and then find a missing receipt or something that you forgot to

enter up front. Then you need to re-calculate all the values because

it ripples through. Inevitably this seems to occur repeatedly. Even with a

handheld calculator, it may consume an hour or more to re-calculate

everything.

- OTS simplifies this process, because the re-calculation becomes just a

momentary button-click.

Writing the final numbers onto the form is actually the easiest part of

the process for me.

- Before about ten years ago, everyone did their taxes by hand. Many

people did not have computers or tax software. And even if they did,

most people had already been accustomed to doing it by hand. But since then,

tax forms have continued to become more complicated - especially the

federal ones. The prevalence of software might have actually encouraged the

trend toward ever more obtuse taxation.

- If you ever did your taxes before, OTS's direct entry method is much faster

than the tedious interview approach implemented in the popular commercial tax software.

Although interview method is OK for first timers.

I volunteer for a group that helps urban residents do their taxes on Saturday afternoons.

We now use OTS to do everyone's taxes in less than a quarter of the time compared to when we used

[a commercial tax package]. It used to take an hour or two for each person with [the commerical package].

Now we complete each one in just a few minutes. No more long lines at the door!

Plus we save money, which helps our strictly voluntary effort.

- Beware that many commercial software packages nowadays will allow you

to start your federal tax return for free. But then after you have

spent time with it, they demand a fee, perhaps due to a situation

that is not covered, or to perform some action, like filing or

importing to your state return.

- Even if you hired a tax professional or used commercial software last

year, or in prior years, if your situation has not appreciably changed,

then you may not need to hire them again unless or until it does. Just

look at last year's return to see what numbers they entered, and where

they entered them. The rest is purely mechanical, especially with

nice tools like OTS.

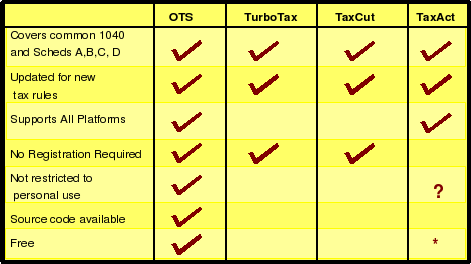

Hypothetical Comparison

* TaxAct offers an over-the-internet form-fillout option, free after registering, but you print your own forms

not for e-filing.

* TaxAct offers an over-the-internet form-fillout option, free after registering, but you print your own forms

not for e-filing.

** TurboTax Basic - You may not use the software to prepare tax returns, schedules

or worksheets on a professional basis (ie. for a preparer's or other fee).

*** TaxCut Standard - Use restricted on one computer at a time, and may not share the software

with any other person.

**** TaxAct Online - Limited to Consumer's personal return, does not apply if Consumer uses

TaxACT to prepare returns for persons or entities other than Consumer. (Free to file paper return,

but still asks questions to support electronic filing.)

Return to OpenTaxSolver

|