Open-source Tax Solver (OTS)- Project - https://sourceforge.net/projects/opentaxsolver/ OpenTaxSolver (OTS) is a free, safe + secure program for calculating Tax Form entries for Federal and State personal income taxes. It automatically fills-out and prints your forms for mailing.

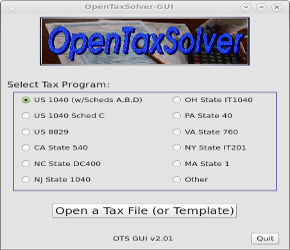

News:Updating has begun for the next tax-year, 2025, which will be due April 15, 2026.Generally the final versions of the Government's forms are not released until near the end of January. They could be delayed further if there are major changes - which we do expect this time. Some OTS updates have begun in October for the upcoming year. Then the initial release for OTS is usually posted within about a week after the final Government forms are posted. So we are expecting near the end of January 2026. A couple weeks before the first update is posted, beta versions are released almost daily via our SVN source code repository, around early to mid January. Our testers are extremely valuable checking the early releases. Check back here in the new year for updates. The OTS package covers popular Federal IRS forms, and twelve (12) of the largest states which impose income taxes. The forms include the Federal-1040, Schedules 1-3 along with Schedules A-D, and the states of VA, NC, OH, NJ, MA, PA, CA, AZ, MI, OR, MI, and NY. The package also includes form programs for the Health Savings Account (HSA) Form 8889 and Form 8606 for Nondeductible IRAs, Schedule-SE, Forms 2210, 8812, 8829, 8959, 8960, 8995 and California Form 5805 - all accessed under the Other Forms bullet of the OTS GUI front screen. If you encounter any problems, then write to aston_roberts@yahoo.com. Please include in any messages: the version of OTS, your Operating System (OS), which Form(s), and how you are using OTS (by GUI or command-line). Always check back here periodically for updates and downloads. Tax forms for 2024 filed under extension were due by October 15, 2025.

All fields in the filled-out PDF forms can be changed or edited with Libre-Office Draw. Movies: OTS has two movies on Youtube:

Auto-Fillout: Saves time by filling out the answers onto the actual government PDF tax-forms. Auto-Fillout of PDF Forms is now available for all forms supported OTS (Federal & State). You will see the Auto-Fillout option when you click Print.

Mailing List:

General:

You can check the OTS Blog for status updates. All -updates, -notifications of issues, and -contributions of additional forms -- from you, the community -- are much appreciated! Special thanks again to all contributors.

OTS FaceBook Page:

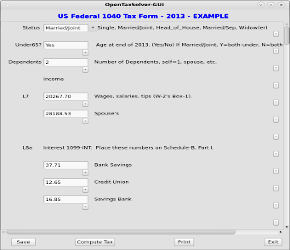

Donate: OverviewThe OTS tax package is intended to be used with the Tax booklets published by your government for determining what numbers you need to enter, and then it assists you in doing the otherwise tedious calculations while showing the intermediate and final numbers. It takes care of the tedious and error-prone work.OTS is intended for those who are comfortable doing their own taxes - especially those who have previously done their taxes and basically understand how to fill out the forms. OTS does much of the math for you. The OTS_GUI is the default Graphical User Interface. The GUI allows you to conveniently enter tax data, and then invokes the appropriate text program when you press the Compute button. Alternatively, you can directly enter your tax data by editing the text files with your favorite text editor, and then process it by invoking the appropriate tax-solver program. Most people nowadays use the GUI, so that is the default mode according to instructions in the package. Behind the GUI is a text-window. It shows the actual commands the GUI uses when you press buttons. You can look at that, if you wish, to learn how to run the same commands directly from your command-line. Since the GUI is fairly self-explanatory, the detailed documentation focuses on how the core text programs work, for those interested.

Example screen shots of OTS_GUI. Although originally created for US 1040 tax forms, the core routines have also been used to solve other tax forms, and for other countries or states. Some basic error checking is included. While the OTS programs developed over many years, results have often been checked against commercial packages. The answers produced by OTS typically matched to within a dollar or so, differing sometimes by rounding effects. Certainly your mileage may vary. Always double-check your tax forms!!

Documentation

Download OpenTaxSolverOpenTaxSolver for the most recent (2024) Tax Year can be downloaded from:Source code and compiled executables are available in all download packages. Example form-data files are included for all forms. Typical package size is about 10-30 MB (reasonably small by today's standards), which includes all the PDF forms. Prior year's versions are available at Downloads.

Unpacking

Tar packages contain precompiled executables for Linux (64-bit), and MacOSx.

Other Links

Feedback welcome.

Aston Roberts - aston_roberts@yahoo.com |